Dr. Christy Ann Petit (Dublin City University)

NextGenerationEU (NGEU) and its attached legal and policy frameworks represent a groundbreaking and unprecedented move towards further EU economic and fiscal integration. Not only has it helped raise EU funding via common borrowing to face the economic and social consequences of the COVID-19 pandemic, but it has also made this funding programme geared towards the future and the ‘next generations’. Yet we are still awaiting to see if policymakers will build on this precedent with ambition and vision. In the post-pandemic era and in a tense geopolitical situation, NGEU could serve as a model for future EU policies and legislative initiatives by the 2024-2029 European Commission. Among others, the search for more financing sources for an EU defense policy with the issuance of bonds and another program of EU common borrowing, is intensively discussed, and remains, at the time of writing, highly uncertain.

NGEU and related developments – which are at the core of the activities of the REBUILD Jean Monnet Centre of Excellence this academic year – showed a profound change to the EU economic governance architecture. A major innovation is the size of EU common borrowing, which in early 2024, amounted to €408.8 billion in long-term bonds and €123.9 billion in EU bills (European Central Bank (ECB) data, January 2024). This is the debut of an EU fiscal capacity, despite its temporary nature. Furthermore, the National Recovery and Resilience Plans (NRRPs) interact closely with economic governance insofar as the RRF has been an incentive to implement the country-specific recommendations (CSR) within the European semester, which is accelerating national structural reforms. All 27 Member States’ NRRPs were revised by the end of 2023 to take into account the energy crisis, high inflation and the global situation, following Russia’s war in Ukraine (with 23 so-called RePowerEU chapters and further changes due to natural disasters in Greece, Slovenia and Croatia).

In early 2024, we are half-way through the implementation of the Recovery and Resilience Facility (RRF) – at the core of the NGEU plan – with data showing that Member States are undertaking reforms falling under the green and digital transitions as well as other structural and investment reforms. Overall, Member States have targeted investments in, inter alia, energy efficiency, renewable energy, and digitalization. Reportedly, all Member States’ NRRPs exceeded the 37% climate target. In line with the performance-based approach, they met more than 1,150 milestones and targets that were considered ‘satisfactorily fulfilled’ by the Commission in February 2024.

Remarkably, the European Commission’s estimates showed that between 2019 and 2025, nearly half of the expected increase in public investment can be associated to the investment financed by the EU budget, in particular the RRF. This led EU institutions to highlight, in Spring 2024, that the figure of public investment could reach 3,4% of GDP in the EU in 2024 (from 3% in 2019).

In Ireland, €914 million will be disbursed in grants. The Irish NRRP allocates 42% to the climate target to contribute to its fight against climate change, 34% to the digital target to support Ireland ‘fit for the digital age’, and 33% on social spending. The latter covers a range of areas, including tackling tax planning (with a reform of corporate tax rules), strengthening the anti-money laundering framework, and the quality and inclusiveness of education (with upskilling and reskilling).

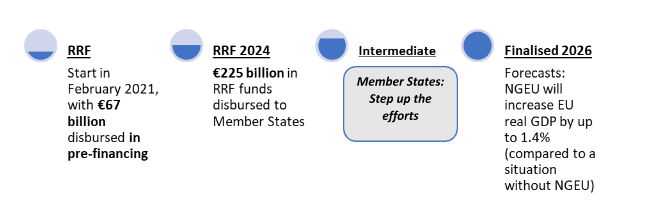

Figure 1. Timeline of the Recovery and Resilience Facility (RRF)

This figure is based on the mid-way assessment of the RRF, with data communicated by the European Commission (February 2024).

The full assessment is scheduled for 2028, when an ex post evaluation of the RRF will take place. This is counting on the fact that, by then, the Member States will have fully implemented the measures included in their NRRPs, which require in the meantime that ‘governments step up efforts,’ in the words of ECB Executive Board Member and Chief Economist Philip Lane, who delivered the final keynote at the 2024 Annual Conference of the Jean Monnet Centre of Excellence REBUILD.

Christy Ann Petit is Assistant Professor at the School of Law and Government of Dublin City University (DCU) and Deputy Director of the DCU Brexit Institute. Her research interests cover EU Law, financial supervision and regulation, the law of the Banking Union, the Economic and Monetary Union, and central banking. She tweets from @petit_christy.

The views expressed in this blog post are the position of the author and not necessarily those of DCU’s Jean Monnet Centre of Excellence REBUILD blog.